Riley Principal 150 Merger Corp. (BRPM) has submitted an amended filing to the SEC that includes details on its proposed business combination with FaZe Clan.

The SPAC merger — initially announced in October 2021 — would result in FaZe becoming a publicly-traded company on the NASDAQ stock exchange.

What’s in the filing?

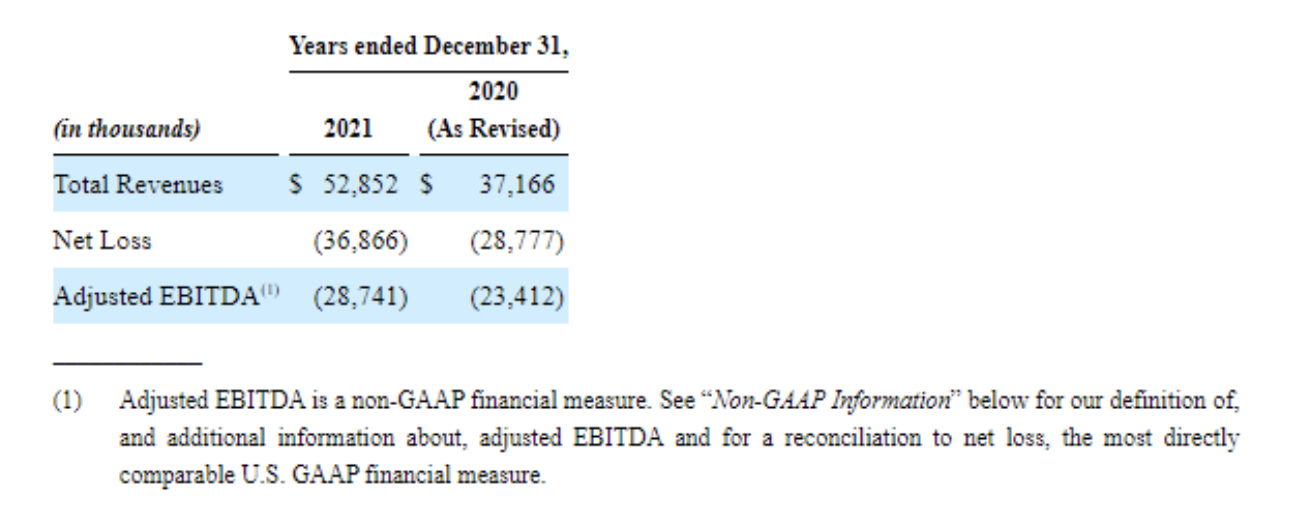

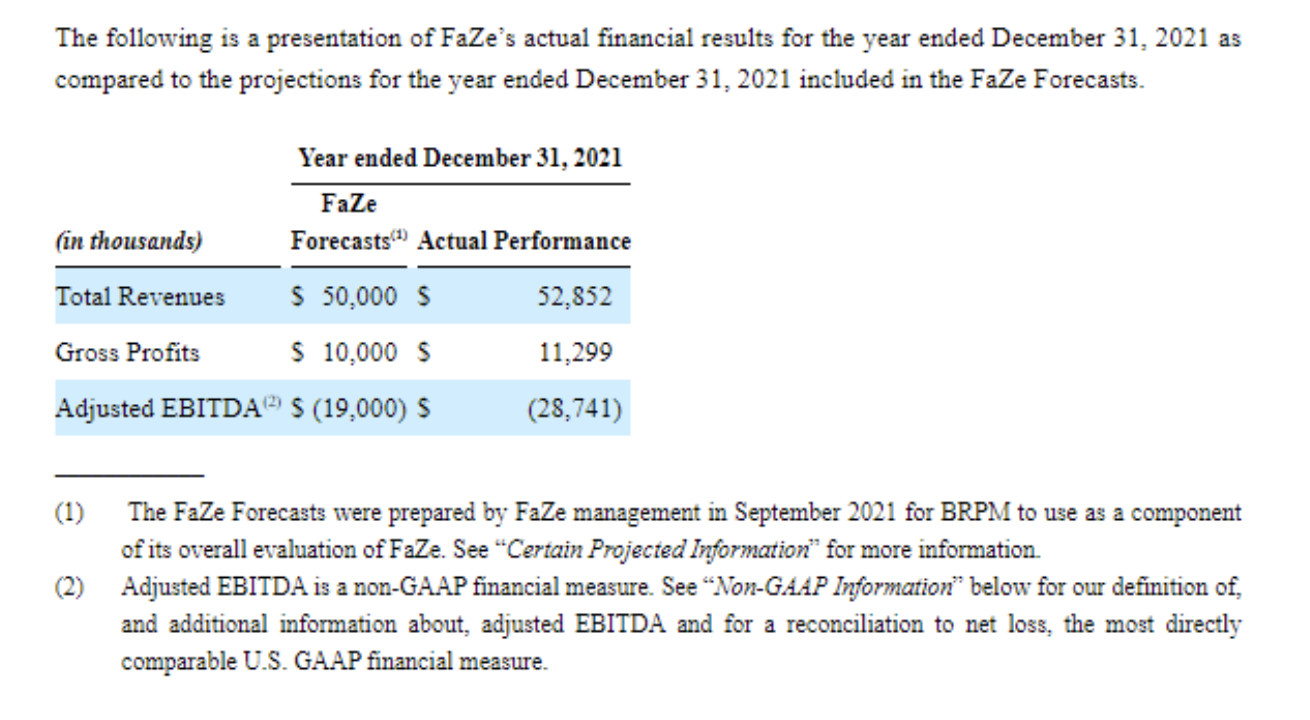

In the amended S-4/A filing, BRPM indicated that FaZe fell short of EBITDA (Earnings before interest, taxes, depreciation, and amortisation) projections by $9.74m (~£7.75m).

BRPM pointed to higher than expected costs for original programming, additional executive hires and changes to accounting practices and forecasting methodology as reasons for these results.

FaZe’s 2021 results reveal that total revenues grew by 42 percent, while net losses also grew by 28 percent.

RELATED: FaZe Clan announces partnership with Current

Although the adjusted EBITDA is lower than the projected -$19m (~ -£15.1m), the actual results confirm this discrepancy was driven by increased costs. FaZe outperformed projected revenue and gross profits by 5.7 percent and 13 percent respectively.

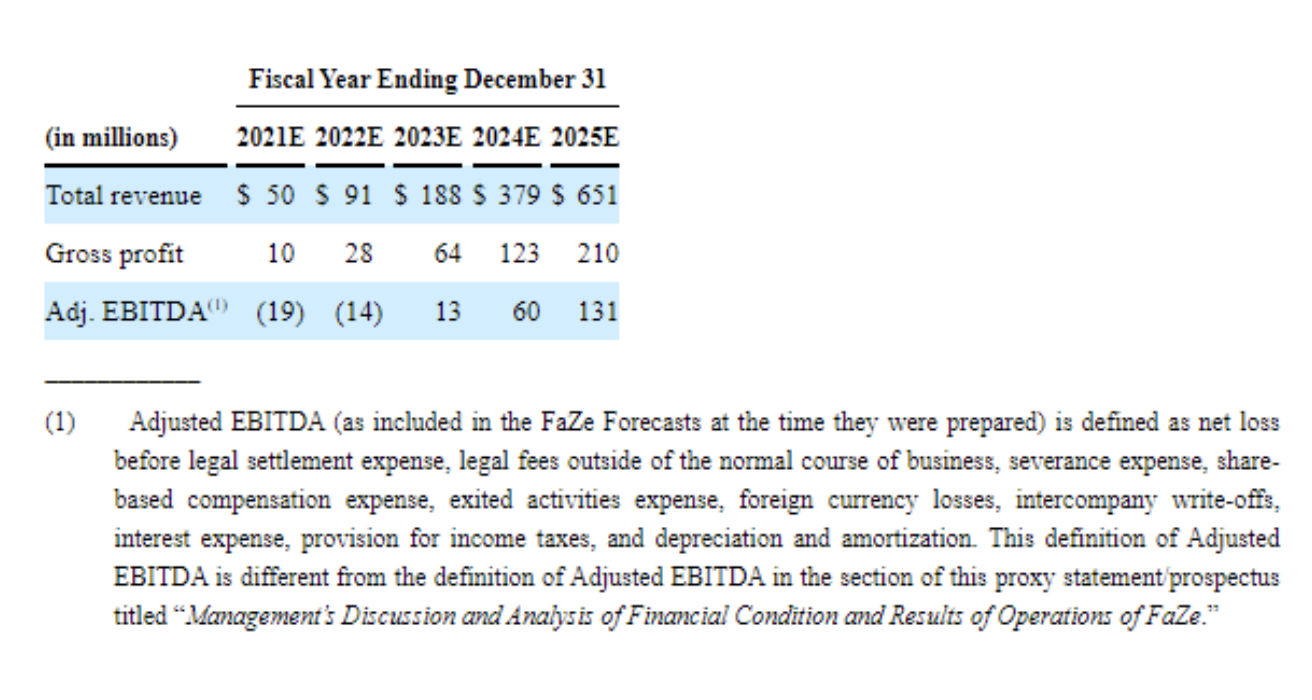

While the missed projection for adjusted EBITDA is a potential cause for concern, BRPM’s estimates indicate that it does not expect FaZe to reach a positive EBITDA until the end of 2023.

Legal obligations and fiduciary duty

The purpose of an S-4 filing is to inform the Securities and Exchange Commission (SEC), potential investors, and the general public about the essential facts of a company prior to a merger or acquisition. As a result, BRPM is required to disclose the terms of the deal and any risk factors that could impact the business.

The document includes a section dedicated to analysing risk factors that could impact FaZe clan. These include the changing competitive landscape, effectively managing rapid growth, the ability to recruit and retain talent, regulatory challenges, COVID-19, disruptions or changes from social media and streaming platforms, and more.

Throughout the document, BRPM cautions that the original FaZe forecasts “were not prepared with a view towards public disclosure or compliance with the published guidelines of the SEC or… the American Institute of Certified Public Accountants.”

There has been considerable concern on social media about the inaccuracy of the FaZe forecasts and its failure to meet its projected EBITDA.

RELATED: FaZe Clan announces partnership with RESPAWN

While the increasing costs are important, the filing asserts that “the FaZe Forecasts represented only one of the various factors considered by the BRPM Board in approving the Business Combination… the BRPM Board did not place an undue reliance on these FaZe Forecasts.”

Esports is not as established as other industries, introducing uncertainty that can result in less accurate financial models. As more esports companies go public and more data is available on their performance, the accuracy of models should improve. This will help businesses like FaZe make more accurate forecasts in the long term.

How will this impact the merger?

The FaZe clan deal is structured as a SPAC merger with B. Riley Principal 150 Merger Corp. A SPAC (Special Purpose Acquisition Company) is designed to raise funds via an Initial Public Offering (IPO). These funds are then used to buy and merge with another existing company.

However, there is a catch to SPACs. They have a limited timeframe to complete a deal. If BRPM does not complete a deal by February 23, 2023, BRPM would be required to liquidate and return all money in the fund to shareholders. If a deal is not completed this could be considered a waste of time and resources and could affect B. Riley’s reputation with their clients and investors.

RELATED: FaZe Clan unveils public Board of Directors, Stephanie McMahon among names announced

Additionally, most companies who are operating SPACs often receive significant benefits as a result of taking on the administration and management of the fund. The filing discloses that B. Riley will earn “approximately $9.6m in fees that are contingent on the completion of the Business Combination.” On the other hand if a merger is not completed, B. Riley would be responsible for any costs incurred by the SPAC prior to liquidation.

As a result, if B. Riley still has confidence in FaZe Clan’s long term prospects, it is in their best interest to complete the deal. While it is possible that these changes to the forecasts could deter B. Riley, there are other considerations such as the limited timeframe, potential impact on the firm’s reputation, and the financial benefits that could outweigh this concern.

Esports Insider says: The FaZe clan SPAC Merger is one of the most significant M&A deals in esports, and with that comes increased scrutiny from fans, industry insiders, and investors. FaZe’s September 2021 forecasts failed to account for increased costs, but the filing revealed that B. Riley does not expect a positive EBITDA until 2023 and FaZe outperformed revenue projections. In all likelihood, these increased costs will not stop the deal.